In a dramatic reversal, the crypto market faced a wave of forced sell-offs as crypto liquidations exceeded $1.8 billion over a 24-hour period, toppling prices of major assets like Bitcoin and Ethereum. Data from CoinGlass showed more than 370,000 traders were liquidated, primarily on leveraged long positions.

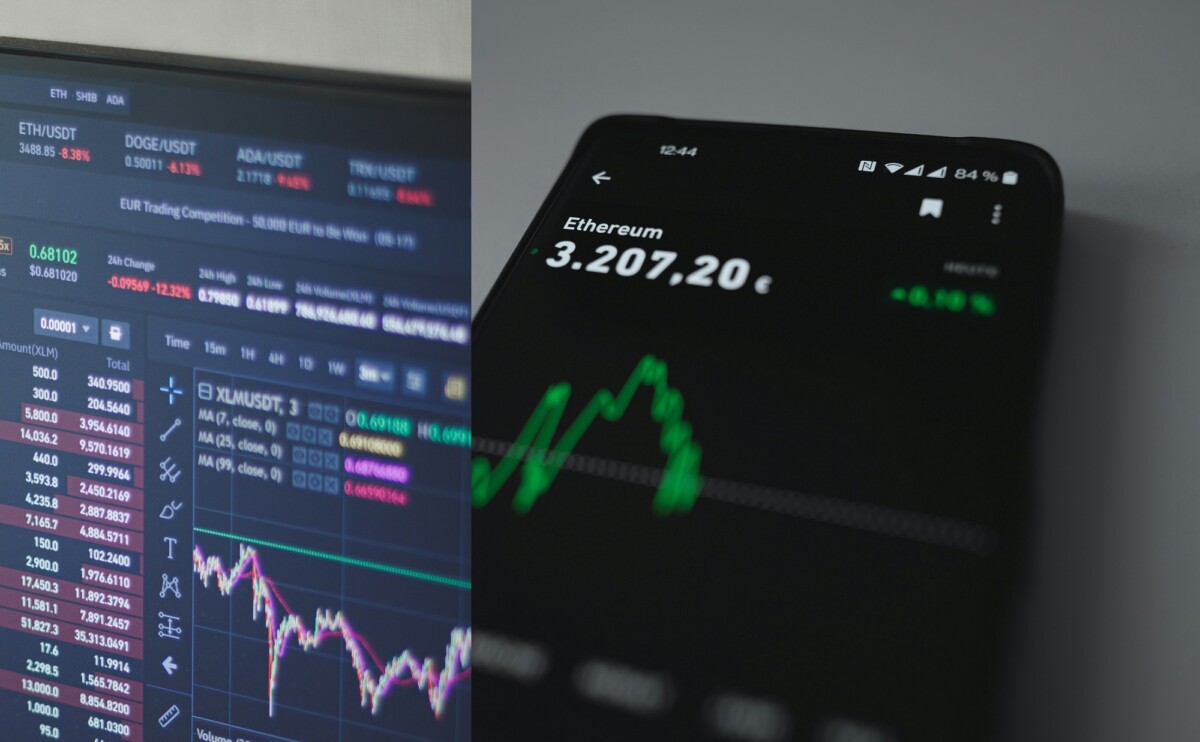

Bitcoin tumbled below $112,000, while Ethereum dropped under $4,150, marking one of the steepest single-day corrections of 2025 in the crypto sector.

What Caused the Liquidation Cascade?

Market watchers attribute the crypto liquidations primarily to a mix of excessive leverage, thin market liquidity, and rapid pullback from overextended positions. Analysts point out that most of the $1.8B in losses stemmed from long bets being forcefully unwound.

- Longs take the hit: Roughly $1.65 billion of the total liquidations came from long traders, with only a fraction from short positions.

- Altcoin pressure: Ethereum was hit particularly hard, accounting for a large share of liquidated volume.

- Price triggers and margin calls: The cascading effect accelerated as dips triggered stop-losses and forced position closures, pushing prices even lower.

The overall market cap contracted by over $150 billion, bringing total crypto valuation down to about $3.95 trillion.

How Nvidia’s China Export Restrictions Affect Crypto Mining in 2025

Market Reactions & Expert Analysis

Observers framed the selloff as a “flush” rather than a collapse in fundamentals. Maja Vujinovic, CEO of FG Nexus, commented that the $1.7–$1.8B in crypto liquidations reflect overleveraged positioning, not deteriorating fundamentals. She suggested the unwind could lay the foundation for a healthier base in the near term.

Still, caution prevails. Technical analysts warn Bitcoin may test support in the $105,000–$100,000 range if bearish momentum continues.

Other macro risks are in play, including rate policy uncertainty and global volatility, which further weigh on risk assets.

Implications for Traders and Investors

- Heightened volatility: The scale of crypto liquidations can spark sharp intraday swings.

- Risk of leverage: Traders using high leverage are especially vulnerable to margin calls in sudden price drops.

- Opportunity for buyers: Some see this as a “reset” moment to accumulate major assets at lower levels.

- Need for caution: Given the rapid movement, investors should monitor support levels (e.g. $105,000 for Bitcoin) and avoid overexposure.

- Long-term view matters: While the short term is volatile, fundamentals such as adoption, institutional flows, and regulation remain central to crypto’s trajectory.

FAQs

A: Crypto liquidations refer to the forced closure of leveraged positions when margin requirements are not met, typically triggered by rapid price moves against those positions.

A: Over $1.8 billion in positions were liquidated in 24 hours, with the majority of that coming from long bets.

A: Bitcoin and Ethereum bore the brunt, with Ethereum seeing especially large losses. Many altcoins also suffered sharp declines in tandem with the leveraged unwind.

The crypto liquidations of the past 24 hours underscore the risks inherent in highly leveraged markets. While some view it as a recalibration, others remain cautious as markets digest this correction.