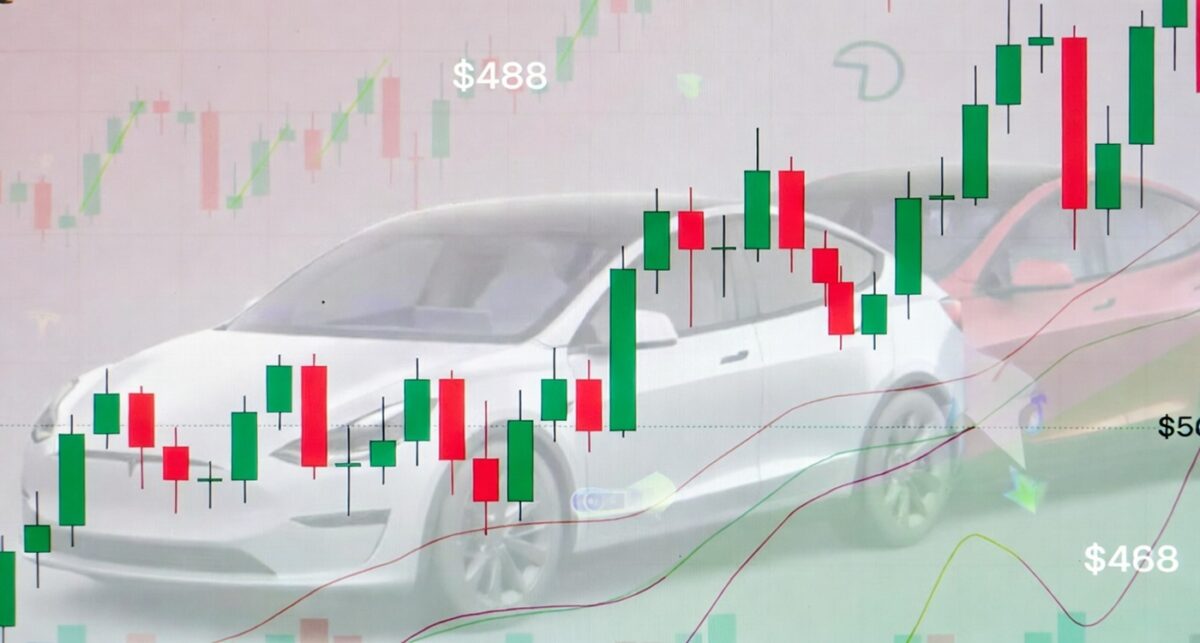

In December 2025, Tesla stock hit a fresh all-time high, reaching up to $488.81 per share as investor sentiment turned sharply positive following a dramatic rebound from April lows — more than doubling in value amid optimism around autonomous vehicle technology and strategic long-term growth catalysts. Analysts are now clustering price targets around $500, with some bullish forecasts extending to $550+ as traders position for potential gains into the company’s January earnings report.

The Milestone — Tesla’s December 2025 Run

Record Levels Confirmed:

- Tesla shares hit a new all-time high of $488.81 on December 16, 2025, surpassing the previous 52-week peak of roughly $488.54.

- The stock’s six-month performance shows nearly a 50% gain, rebounding from a steep slump earlier in the year.

- This rally has been widely documented across financial markets reports and equity research headlines in late-December trading sessions.

Earlier in 2025, Tesla endured a brutal drawdown — shares touched multi-month lows after EV sales softness and broader market headwinds — only to pivot on fresh narratives around autonomy, AI, and robotics that reignited investor interest.

Why the Surge? From April Lows to December Highs

A Narrative Shift From EV Slowdown to Tech Growth

From my years covering automotive and tech stocks, this sort of narrative rotation is critical: companies priced as growth plays can see rapid sentiment reversals once investors believe future optionality outweighs current fundamental challenges.

Two dynamics drove Tesla’s shift:

- Autonomous Driving & Robotaxi Buzz:

Tesla’s testing of fully autonomous robotaxis — including programs that reportedly run without safety drivers — has created a forward-looking story that attracts not just EV bulls, but tech growth capital. - Robotics & AI Integration:

The market increasingly values Tesla as more than a carmaker — akin to a software and robotics firm, a stance bolstered by its Optimus humanoid robot and AI ambitions. Analysts have repeatedly cited these segments as core to the valuation uplift.

Analyst Price Targets — $500 and Beyond

$500 – A Realistic, Near-Term Target

Several brokerages and Wall Street research teams maintain overweight or buy ratings with near-term targets around $500:

- Piper Sandler reiterated an Overweight rating with a $500 target, underscoring confidence in Tesla’s growth prospects.

- Deutsche Bank lifted its target to $500, contributing to the stock’s momentum in recent sessions.

This $500 level functions as a technical and psychological zone — just above current trading and within reach as we head into January earnings. Breaking and holding above this number could set the next leg of the rally.

What About $550+ and Longer-Term Targets?

There are bullish outliers among analysts who see further upside:

- Canaccord Genuity raised its price target to $551, citing Tesla’s long-term growth drivers such as expanded EV penetration in emerging markets and autonomous tech prospects.

- In broader sentiment, some research narratives — particularly from Wedbush — have floated even higher ceilings tied to autonomous vehicles and AI value realization (though markets remain divided on the timing and feasibility).

These more aggressive figures are typically tied to optionalities (robotaxi deployment, AI monetization, Optimus robotics adoption), which, while not yet revenue drivers, are enough for many institutional investors to underwrite extended multiples.

What’s Powering Options Interest Ahead of January Earnings

With prices perilously close to significant price targets, options activity around TSLA has increased markedly — especially in the call (bullish) market.

- Traders have been rolling into higher strike calls, betting on continuation into earnings and potentially beyond $500 levels.

- Heavy volume in out-of-the-money call spreads suggests those positioning see greater upside than downside in the near term.

This elevated options interest is a sentiment barometer — when traders are betting on upside before an earnings catalyst, it often reflects a broader market belief that catalysts (like January earnings or guidance) could re-rate the stock upward.

Broader Market and Macro Drivers

Investor Confidence in Tech vs. Traditional EV Sales

Despite weaker vehicle deliveries in 2025 — particularly in key markets like China — Tesla has leveraged its story arc toward tech innovation. Unlike pure EV revenue plays, autonomous systems and AI “growth optionality” have attracted capital typically reserved for high-beta tech names.

Furthermore, even as indices like the S&P 500 or Nasdaq fluctuate, Tesla’s resilience is notable: it has outperformed many broad indices through rotational flows toward growth stocks.

Regulatory and Competitive Landscape

However, this bullish picture isn’t without headwinds:

- Tesla faces scrutiny over Autopilot marketing in California — though immediate impacts have been delayed, these regulatory pressures persist.

- Analysts remain divided; while some retain high price targets, others maintain neutral or hold ratings, suggesting valuation risks remain as Tesla works through sales, margin, and macroeconomic headwinds.

This divergence in analyst ratings is normal at extremes of valuation — bullish narratives attract aggressive targets, while cautious voices anchor expectations.

Risks and Counterpoints Ahead of January Earnings

Whether this rally persists will hinge on several catalysts and risks:

- January Earnings: Tesla’s upcoming earnings release is arguably the biggest near-term catalyst. Beats on deliveries, margins, or autonomous revenue guidance could validate the $500+ thesis; misses could trigger profit-taking.

- Sales Trends: Weakness in major markets — particularly China and California — could blunt the story if guidance doesn’t show clear improvement.

- Valuation Multiples: Tesla’s current multiples remain elevated relative to traditional automakers — a continued divergence will keep growth expectations priced into every share move.

Conclusion: A Rally Defined by Narrative and Optionality

From the April lows to December’s record highs near $488, Tesla’s stock performance in 2025 underscores a market that isn’t just investing in cars — it’s investing in the idea of transformative technology. Whether that pays off in actual revenue and earnings remains the central question for 2026.

Editorial Outlook:

If Tesla delivers stronger guidance in January — particularly around autonomous deployment and AI revenue streams — the $500 target could look conservative. Conversely, if earnings highlight continued EV demand softness without clear traction in new segments, this rally could stall.

In short: Tesla’s stock price now reflects ambition as much as execution. Investors should watch earnings closely — that report could be how this story splits between lasting rally or short-term peak.