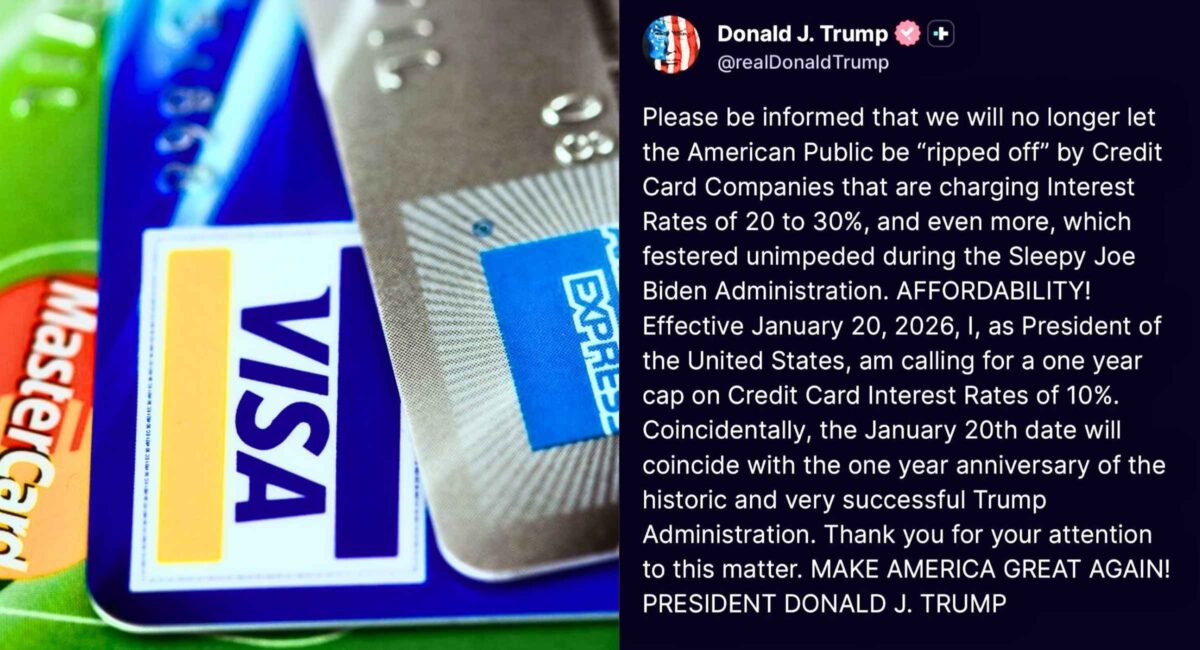

President Donald Trump on January 10, 2026 announced a high-profile domestic policy initiative calling for a one-year cap on credit card interest rates at 10 percent, set to take effect on January 20, 2026 — the first anniversary of his return to the White House. In a series of posts on his social media platform, Trump framed the proposal as a fight against what he described as “ripping off the American public” by credit card companies charging rates as high as 20 %–30 % or more, which he said had persisted under the previous administration. However, the plan currently lacks specifics on implementation or enforcement and would almost certainly require congressional action to have legal force.

Under Trump’s outline, the 10 % cap is intended to reduce borrowing costs for millions of Americans struggling with high credit card debt. The president’s announcement, tied to a broader affordability narrative ahead of pivotal 2026 midterm elections, prompted immediate debate over both its feasibility and economic impact — from bipartisan interest on Capitol Hill to strong pushback from banking industry groups.

Policy Proposal: Goals, Timeline, and Legal Questions

In his January 9 social media post and subsequent statements, Trump stated that effective January 20, 2026, his administration would seek to cap credit card interest at 10 percent for one year. He positioned the measure as part of a broader response to rising costs of living and consumer financial strain, which has seen national average credit card interest rates near 20 % in recent months according to Federal Reserve data.

However, neither the presidential announcement nor accompanying White House statements outlined how this cap would be enforced under current law. Experts and lawmakers note that the federal government cannot unilaterally impose such a cap without legislation — meaning the proposal would need Congressional approval and statutory authority before becoming binding on issuers. Bipartisan bills with similar goals, including one from Senators Bernie Sanders (I-Vt.) and Josh Hawley (R-Mo.), have been introduced in previous sessions but have not been enacted into law.

Political reactions were swift. Some lawmakers welcomed the focus on credit affordability, while critics — including Senator Elizabeth Warren — dismissed the announcement as hollow without legislative backing. The juxtaposition of presidential rhetoric versus legal reality raised immediate questions about the proposal’s practical path forward.

Bank Pushback and Economic Implications

Financial industry groups and analysts have broadly warned against imposing a 10 % cap without careful consideration of unintended consequences. In letters to Congressional leaders, associations representing banks and credit unions argued that such a cap could severely restrict access to credit, particularly for consumers with lower credit scores. They contended that lenders may be forced to tighten underwriting standards, reduce card offerings, or eliminate rewards programs — outcomes that could leave millions with limited or no access to mainstream credit and potentially pushed toward higher-risk alternatives such as payday loans or auto-title lending.

While proponents argue a cap could return tens of billions of dollars to American consumers — supporting household budgets and reducing interest burdens — critics contend that a strict 10 % rate could render many credit card products economically unviable for lenders, prompting a contraction in credit availability. Billionaire investor Bill Ackman went further, warning that without rates high enough to cover costs and risk, lenders might cancel credit lines, forcing borrowers into unregulated or predatory credit markets.

The banking debate reflects wider tensions over financial regulation: whether government-imposed price controls can genuinely protect consumers without triggering credit scarcity, or whether they will tilt markets in ways that disadvantage those the policies intend to help.

Impact on Borrowers and the Broader Economy

If enacted, a one-year 10 % interest cap could dramatically lower borrowing costs for Americans carrying revolving credit card balances — potentially saving households billions annually on interest payments. Research conducted prior to this announcement suggested that a capped environment might still allow issuers to profit on some segments of cardholders, though reward programs and benefits might be scaled back significantly.

However, potential benefits must be weighed against the risk that issuers could limit issuance to only the most creditworthy consumers, effectively shrinking credit options for lower-income or higher-risk borrowers. Market watchers also speculate that lenders may seek to shift costs to other fee structures — such as annual fees or penalty charges — to compensate for rate limits, altering the overall cost landscape for consumers.

Where Things Stand

As of early January 2026, the 10 % interest cap remains a presidential call to action without legal force, depending on future legislative engagement to materialize into binding regulation. Trump’s announcement highlights growing political focus on consumer financial stress and credit affordability, but the interplay between executive goals, Congressional authority, and industry realities will determine whether this proposal evolves into enforceable policy.

The coming weeks — and the 2026 legislative calendar — will be critical in assessing whether the cap gains traction beyond rhetoric, or remains emblematic of broader domestic policy messaging ahead of midterm elections.