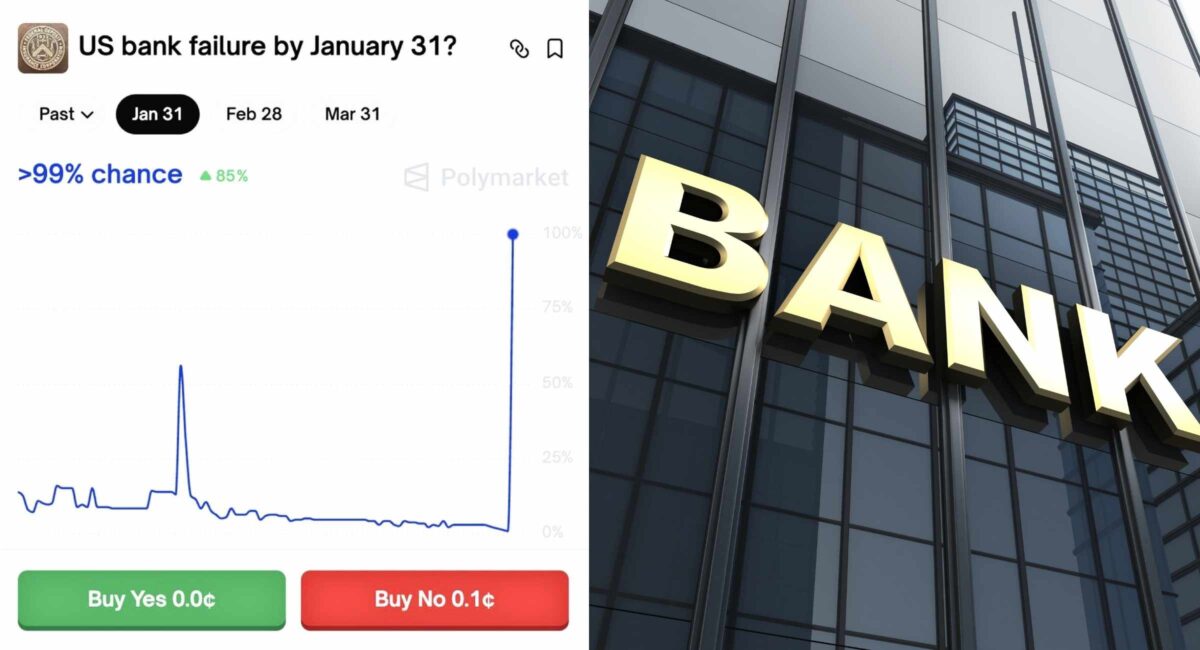

In a year already marked by dramatic financial market swings, the first U.S. bank failure of 2026 has occurred — and it comes alongside a historic sell-off in precious metals, in turn rattling global markets. On January 30–31, 2026, Metropolitan Capital Bank & Trust, a small Chicago-based institution, was abruptly closed by the Illinois Department of Financial and Professional Regulation due to unsafe conditions and weak capital levels, with the Federal Deposit Insurance Corporation (FDIC) stepping in to protect depositors. This event coincided with a violent correction in gold and silver prices — gold down as much as ~11% and silver plummeting ~31% in record single-session moves — fuelled by profit-taking and a sudden rebound in the U.S. dollar that reshaped investor sentiment across asset classes.

What Is the First U.S. Bank Failure of 2026?

Metropolitan Capital Bank & Trust became the first bank in the United States to fail in 2026 when the Illinois Department of Financial and Professional Regulation (IDFPR) closed the bank on January 30, 2026 and appointed the FDIC as receiver. The FDIC arranged for First Independence Bank of Detroit, Michigan to assume substantially all deposits and assets, ensuring that depositors will not lose money and banking services will continue without interruption.

How the Bank Failure Unfolded

Regulatory Action and Closure

The IDFPR seized Metropolitan Capital Bank & Trust — a state-chartered institution with about $261.1 million in assets and $212.1 million in deposits — after determining that the bank was in unsafe and unsound condition with impaired capital. The FDIC was appointed receiver and immediately executed a purchase and assumption agreement with First Independence Bank to protect customers.

Safe Transition for Customers

- Deposits protected: All deposits transferred automatically to First Independence Bank, backed by FDIC insurance.

- Ongoing access: Customers can use ATM and debit cards, write checks, and access online banking as usual.

- Branch reopening: The sole Chicago office will reopen as a First Independence Bank branch on Monday, February 2, 2026.

According to the FDIC, no depositor will lose money due to the closure, and existing account numbers, routing numbers, and services will remain intact through the transition.

Cost to the FDIC Insurance Fund

The FDIC preliminarily estimates the failure will cost the Deposit Insurance Fund (DIF) about $19.7 million, though this number may change as retained assets are sold over time.

Why the Failure Matters — Even If It’s Small

Though Metropolitan Capital Bank & Trust was modest in size relative to major financial institutions, its failure is noteworthy for several reasons:

- Signal of strain: Amid broader economic uncertainty and shifting financial conditions, even smaller banks can come under pressure.

- Market sentiment: Bank failures — no matter the size — often ripple through investor psychology, especially when coinciding with sharp moves in correlated markets like commodities and equities.

- Historical reference: Early bank failures in a calendar year can preview wider trends or vulnerabilities in the banking sector.

Historically, FDIC records trace bank failures regularly back through multiple decades — but most closures occur for smaller institutions without widespread disruption to the broader financial system.

The Broader Market Backdrop: Precious Metals Sell-Off

In a dramatic juxtaposition to the bank failure, gold and silver markets experienced one of the worst single-session declines in decades at the end of January 2026. Precious metals had hit record highs earlier in the month, driven by a year-long rally as safe-haven demand surged, but the final trading session saw massive unwind pressures.

Gold’s Sharp Drop

Gold futures plunged around 11% in a single session — one of the largest percentage declines in recent history — reversing steep gains from earlier in the week.

Silver’s Steep Crash

Silver’s sell-off was even more dramatic, with futures falling over 30% — the deepest drop since similar historic episodes in 1980 — as traders aggressively booked profits and the dollar strengthened.

Driver: Stronger Dollar and Profit-Taking

Market analysts attributed the plunge to a sudden rebound in the U.S. dollar, heightened by investors’ reassessment of monetary policy expectations (including speculation around Federal Reserve leadership shifts), combined with heavy profit-taking after parabolic metal rallies. The resulting unwind was exacerbated by leveraged positions and margin calls, sharply accelerating price declines.

Connecting the Dots: Bank Failure and Macro Markets

While the bank closure and precious metals crash occurred in close temporal proximity, it’s important to unpack how such events can interact in the financial ecosystem:

1. Financial Stress and Liquidity Cycles

Bank stress, even at smaller institutions, can reflect credit conditions and capital adequacy issues that resonate beyond core banking. When markets sense elevated risk, liquidity can tighten, making volatile assets like precious metals more susceptible to sharp reversals as investors rebalance portfolios.

2. Risk Sentiment Shifts

The adjustment in precious metals pricing — from record highs to deep corrections — often mirrors risk-off to neutral transitions in global markets. At moments of peak euphoria, large long positions in metals can build up; when news (such as central bank policy shifts or economic data) disrupts that narrative, rapid de-risking can occur.

3. Dollar Dynamics

A stronger U.S. dollar exerts downward pressure on commodities traded in dollar terms, like gold and silver. When the dollar strengthens — as it did recently — precious metals suddenly become more expensive in foreign currencies, prompting selling that can cascade through leveraged markets.

What Investors Are Saying

Market participants expressed surprise at the sharp reversal in precious metals. Some pointed out that euphoria in metals had stretched well beyond fundamentals, with silver in particular experiencing speculative inflows that made it especially vulnerable to a sharp correction once sentiment shifted. Others noted that profit booking is a normal phase after extraordinary rallies, especially when markets reassess monetary policy expectations and the trajectory of inflation risk.

In discussions across financial forums and trading communities, many observers emphasized that while short-term volatility can be intense, longer-term fundamentals — including industrial demand for silver and central bank gold reserves — remain relevant for future pricing dynamics. (Discussion themes informed by multiple market commentary.)

Lessons from the First Bank Failure of 2026

- Deposit Protection Works: Even when a small bank fails, the FDIC’s established protocols ensure depositors don’t lose insured funds — a cornerstone of confidence in the U.S. banking system.

- Market Psychology Matters: Sharp shifts in sentiment — whether in metals or banking — can have outsized impact on correlated markets and risk pricing.

- Volatility Isn’t Insulation: High-flying assets like precious metals can correct rapidly, especially when influenced by macro drivers like dollar strength and changes in monetary policy expectations.

Outlook: What Comes Next

Banking Sector

The FDIC will continue monitoring small and mid-sized institutions for signs of capital strain. Closures at the start of a calendar year tend to prompt enhanced scrutiny, but they don’t necessarily signal systemic distress absent broader evidence.

Precious Metals

Analysts will watch how metals prices stabilize after a violent sell-off. If profit-taking has exhausted much of the short-term selling pressure, metals may find a new trading range. However, if macroeconomic indicators — such as inflation and rate expectations — shift again, prices could resume trending upward or continue adjusting lower.

Conclusion: A Volatile Beginning to 2026

The first U.S. bank failure of 2026 — Metropolitan Capital Bank & Trust’s closure — reminds us of the enduring strength and limits of the U.S. banking safety net, with the FDIC’s response ensuring depositor protection and continuity of services. At the same time, precious metals markets endured one of the most dramatic single-session reversals in decades, illustrating how quickly investor sentiment can pivot in response to macroeconomic signals like currency strength and monetary policy expectations.

This juxtaposition of banking stress and commodities volatility at the start of 2026 highlights the complex interplay of confidence, policy, and market psychology that shapes financial markets — underscoring the need for investors and observers alike to stay attuned to both fundamentals and sentiment shifts across sectors.