On December 16–17, 2025, U.S. President Donald Trump ordered a “total and complete blockade” of all U.S.-sanctioned oil tankers entering and leaving Venezuela, intensifying pressure on President Nicolás Maduro’s regime, demanding the return of alleged stolen U.S. assets (including claims tied to ExxonMobil), and contributing to a global oil price increase of more than 1% amid fears of supply disruption. The move comes as U.S. courts proceed with the sale of Citgo Petroleum — Venezuela’s key U.S. oil asset — to satisfy creditors, a development Caracas vehemently rejects.

Why This Matters Now (Executive Summary)

- Blockade Order: Trump declared a total blockade of all sanctioned Venezuelan oil tankers — a step beyond traditional sanctions that could amount to a de facto embargo.

- Asset Claims: Trump publicly asserted the U.S. has rights to Venezuelan assets allegedly “stolen,” including past foreign oil company assets such as those appropriated from ExxonMobil under Chávez-era nationalization — an extraordinary claim with major geopolitical risk.

- Citgo Sale: A U.S. federal court in Delaware authorized the sale of Citgo Petroleum (PDV Holding’s U.S. refining arm) to Amber Energy (Elliott Investment Management affiliate), a move Caracas denounces as forced expropriation.

- Oil Prices: Brent and WTI benchmarks rose sharply — reflecting market anxiety over Venezuelan export disruptions.

- Legal, Diplomatic Backlash: Venezuela has called the blockade illegal and akin to piracy, planning to take the issue to the United Nations, while international legal scholars debate its legitimacy.

The Blockade Decision — What Trump Announced

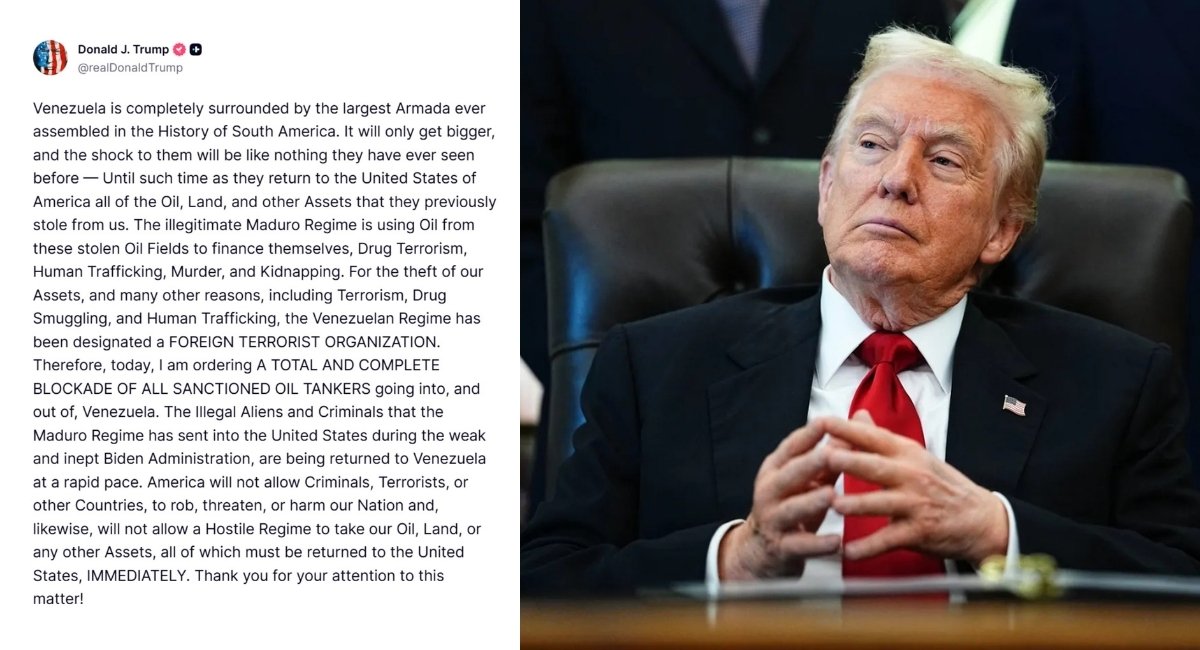

In Late 2025, President Trump used his Truth Social platform to declare Venezuela’s government a “foreign terrorist organization” and ordered “a total and complete blockade of all sanctioned oil tankers going into, and out of, Venezuela.” He framed the move as a response to alleged terrorism, drug trafficking, human trafficking, and theft of U.S. assets.

“It will only get bigger, and the shock to them will be like nothing they have ever seen before — Until such time as they return … all of the Oil, Land, and other Assets that they previously stole from us.” — Trump (as reposted on Truth Social)

Why This Is Unusual

- Naval force: Thousands of U.S. troops, including warships and aircraft carriers, are now positioned in the Caribbean and off Venezuela’s coast.

- Legal ambiguity: Blockades are traditionally treated as acts of war under international law, typically requiring clear congressional authorization and often associated with declared conflicts.

- Domestic Debate: U.S. lawmakers from both parties are questioning the legality and strategic rationale of unilateral military enforcement.

The ExxonMobil & U.S. Asset Demand — What Trump Is Claiming

Trump’s statement included an assertion that Venezuela must return “Oil, Land, and other Assets” it allegedly stole from the United States — a reference to expropriations of foreign investors, most notably ExxonMobil and other Western companies during Venezuelan nationalizations under Hugo Chávez and Nicolás Maduro.

Historical Context

- In the 2000s and 2010s, Venezuela nationalized vast energy and mining assets, including ExxonMobil’s operations, without compensation that met Western legal standards — a longstanding grievance for U.S. oil companies. (Historical context: U.S.–Venezuela oil disputes extend back decades.)

Modern Legal Dynamics

- Trump’s demand is not grounded in any new international arbitration award or treaty enforcement mechanism — rather, it is political rhetoric tied to broader pressure strategy.

Citgo Sale — The Legal and Strategic Battleground

What’s Happening with Citgo?

- Citgo Petroleum Corporation, once wholly owned by Venezuela’s state oil company PDVSA, has been in U.S. court auctions to settle over $20+ billion in debts.

- A U.S. federal judge in Delaware approved the sale of PDV Holding’s shares to Amber Energy (affiliated with Elliott Investment Management) for roughly $5.9 billion, a move expected to conclude by 2026.

Venezuela’s Position

- Caracas calls the sale fraudulent and illegal, vowing to contest it and refusing to recognize the transaction.

- Venezuela’s leadership sees this as part of a broader U.S. campaign to strip it of oil wealth and strategic resources.

What Citgo Means

- Citgo operates three major U.S. refineries averaging ~800,000 barrels per day capacity, key storage terminals, and pipelines across 23 states — a prized asset in the U.S. energy market.

- Losing Citgo cuts Venezuela off from a major revenue stream and could shift refining margin flows to U.S. investors.

Global Oil Market Reaction — Prices and Supply Risk

Immediate Market Response

- Oil prices climbed — WTI above $56/bbl and Brent near $59–$60/bbl — on fears that Venezuelan crude shipments could shrink further.

Why Prices Moved

- Venezuela, holder of the largest proven oil reserves globally, still contributes hundreds of thousands of barrels per day, often to China and secondary markets. Venezuelan spillover volumes — even if small by global standards — mean uncertainty can tighten localized market flows.

- Traders reacted to fears of supply disruptions and rising risk premiums.

Longer-Term Impact

- If the blockade is enforced effectively and shippers avoid Venezuelan crude, markets could see additional upward pressure, especially on heavy sour crude grades.

International and Legal Backlash

Venezuela

- Maduro’s government labeled the blockade a violation of international law, free navigation, and sovereign rights, promising to take the case to the United Nations.

Legal Experts

- Blockades historically require formal war powers or congressional approval; without them, the legal basis for naval interdictions of commercial shipping is murky.

Global Opinion

- Many foreign governments are watching closely, wary of U.S. unilateral use of military force against civilian commerce under sanctions.

What Comes Next — Scenarios and Risks

Scenario 1: Escalation into Broader Conflict

- Continued naval enforcement could provoke military counter-measures or retaliation, with knock-on effects for regional stability.

Scenario 2: Diplomatic Push

- International pressure via the U.N. Security Council or WTO trade dispute mechanisms could force talks or temporary de-escalation.

Scenario 3: Domestic U.S. Pushback

- Congressional intervention to assert war powers or limit military funding could emerge amid bipartisan concern.

Conclusion — The Stakes Are Monumental

This isn’t a routine diplomatic spat. Trump’s blockade order marks one of the most dramatic escalations of U.S.–Venezuelan tensions in decades — combining economic warfare, naval might, asset litigation, and geopolitical brinksmanship. It directly confronts international law norms, global energy markets, and long-standing disputes over foreign oil assets like ExxonMobil and Citgo. The coming weeks will reveal whether this becomes a flashpoint with lasting global repercussions or a pressure tactic that yields negotiated concessions — but for now, markets, militaries, and diplomats are on high alert.