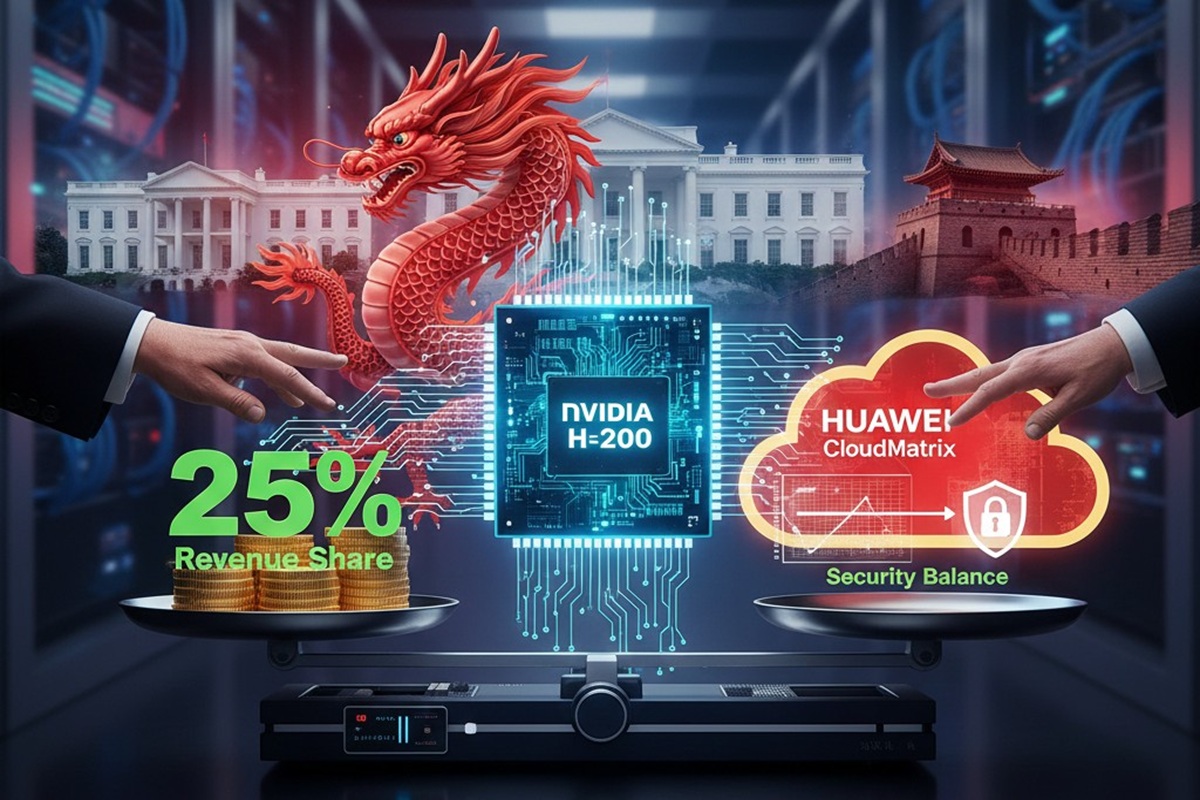

U.S. will permit Nvidia to sell its H200 AI chips to approved Chinese customers after striking a 25% revenue‑share agreement under Donald Trump — a deal that could reshape the global AI‑chip landscape while triggering concern over security and geopolitical risk.

U.S. President Donald Trump on December 8, 2025, authorized Nvidia to resume exports of its H200 artificial‑intelligence chips to China under a deal that requires the United States to receive 25% of sales revenue — marking a significant reversal of prior export controls and reopening a vital channel for AI‑chip commerce.

Full story

What changed — and how

The U.S. Department of Commerce has formally approved exports of Nvidia’s H200 chips to “approved customers” in China, under terms that impose a 25% surcharge (effectively a revenue‑share) payable to the U.S. government.

Trump announced the decision via a post on his social‑media platform, saying he had informed Chinese leader Xi Jinping of the move, and that Beijing responded positively. He pledged the policy “supports American jobs, strengthens U.S. manufacturing, and benefits American taxpayers.”

The agreement explicitly excludes Nvidia’s top‑of‑the‑line offerings — the Blackwell series and the yet‑to‑ship Rubin chips — which remain barred from export to China.

Nvidia welcomed the decision, saying the arrangement with the Commerce Department strikes “a thoughtful balance” between enabling competition and maintaining national security.

Background: from blanket ban to revenue‑share compromise

Export controls on advanced chips to China date back to 2022, when the U.S. sought to limit China’s access to high‑performance semiconductors — a strategic move to preserve America’s lead in AI and deter potential military or surveillance application

Earlier this year, Nvidia had negotiated a partial easing: exports of the downgraded H20 chip to China were approved in exchange for a 15% revenue share. Still, many in Washington criticized the move as risky.

The jump from 15% to 25% appears to reflect a more aggressive approach by the current administration: rather than block exports outright, the U.S. now seeks to monetize China’s demand for AI hardware while retaining oversight.

Analysts familiar with the policy shift told Reuters the decision reflects recognition that fully isolating China technologically may be unrealistic — especially given pressure from companies like Nvidia to regain access to one of the world’s largest AI markets.

Trending Reactions & Public Conversation

On social media, the announcement triggered a flood of commentary. On forums like r/Stocks and r/AMD_Stock, users debated whether the 25% “fee” amounts to a clever revenue‑raising strategy or a dangerous concession. One post summarizes the trade‑off succinctly:

“Trump has removed trade barriers for Nvidia to sell its second most powerful chips to China. In exchange, Nvidia is to hand over 25% of all proceeds.”

Some investors welcomed the move — anticipating Nvidia’s regained access to China could yield billions in sales again. Others cautioned that the fee might suppress demand or encourage Chinese firms to accelerate development of domestic alternatives.

Across platforms, commentators raised broader questions about whether the policy marks a shift from tech containment to commercial opportunism — and whether long‑term national security interests are being compromised for short‑term profit.

Expert Views & Official Responses

Observers at think tanks warn the change could dramatically shift the balance of power in global AI. According to the Council on Foreign Relations (CFR), allowing H200 exports removes one of the last significant obstacles to China rapidly scaling its AI‑computing infrastructure. In a recent analysis, CFR noted that export controls were “the only U.S. policy capable of slowing China’s AI progress” — and with those lifted, China might be able to build data centers rivaling U.S. capabilities within months.

At the same time, the concessions have drawn sharp criticism in Washington. Several senators — including Elizabeth Warren — voiced alarm, calling the decision a “colossal economic and national security failure.”

From the industry side, Nvidia defended the move. In its statement, the company argued the export channel would help sustain U.S. jobs and manufacturing while allowing commercial customers globally to access advanced AI hardware — albeit under tight controls.

Significance & Impact

The policy pivot marks a major recalibration in the U.S.–China technology competition. By monetizing rather than outright blocking exports, Washington appears to be balancing two priorities: capturing revenue from global AI demand, and controlling what hardware China can access.

For Nvidia, the implications are especially significant. If even a fraction of Chinese AI firms resume purchasing H200 chips, the company could restore what had become a dormant revenue stream, potentially worth several billions annually. Analysts estimate that China accounted for as much as 20–25% of Nvidia’s data‑center revenue before export restrictions.

On the Chinese side, access to H200 hardware could accelerate development of more advanced AI models and cloud‑based AI services — narrowing the gap with global leaders. But broad access may depend on further decisions by Chinese regulators, which have reportedly signalled intention to limit purchases despite U.S. export approval.

Politically, the deal could reshape how future U.S.–China tech negotiations unfold. Instead of blanket bans, revenue‑sharing arrangements may become a model for balancing strategic caution with commercial pragmatism.

What Happens Next

- The U.S. Department of Commerce will finalize the licensing framework, including criteria for “approved customers” and any performance‑based limits on H200 chips.

- Other U.S. chipmakers — notably AMD and Intel — are expected to be offered similar export deals, potentially re‑opening Chinese demand for a broader suite of high‑performance chips.

- Chinese regulators may impose their own restrictions or vetting procedures before allowing domestic firms or state‑owned enterprises to adopt H200 hardware — a move that could blunt some of the expected surge in demand.

- Over the medium term, China may accelerate investment in domestic AI‑chip development to reduce reliance on U.S. technology, a trend already underway even before this deal.

Conclusion

By approving exports of Nvidia’s H200 AI chips to China under a 25% revenue‑share deal, the Trump administration has dramatically redrawn the rules of the U.S.–China AI competition. What began as a national security‑driven blockade has morphed into a strategic revenue‑sharing compromise that both unlocks a lucrative market for American chipmakers and risks accelerating China’s AI‑computing ambitions.

Whether this marks a pragmatic recalibration — or an overdue concession with long-term consequences — remains to be seen. For now, the balance between commercial benefit, national security, and technological rivalry has shifted once again.