Yes — the crypto market has indeed taken a painful hit, with roughly $140 billion wiped out as Bitcoin fell about 5%, and Ethereum dropped below $3,000. A wave of forced liquidations triggered a sudden sell-off across the board, putting pressure on nearly all major digital assets.

Key Takeaways

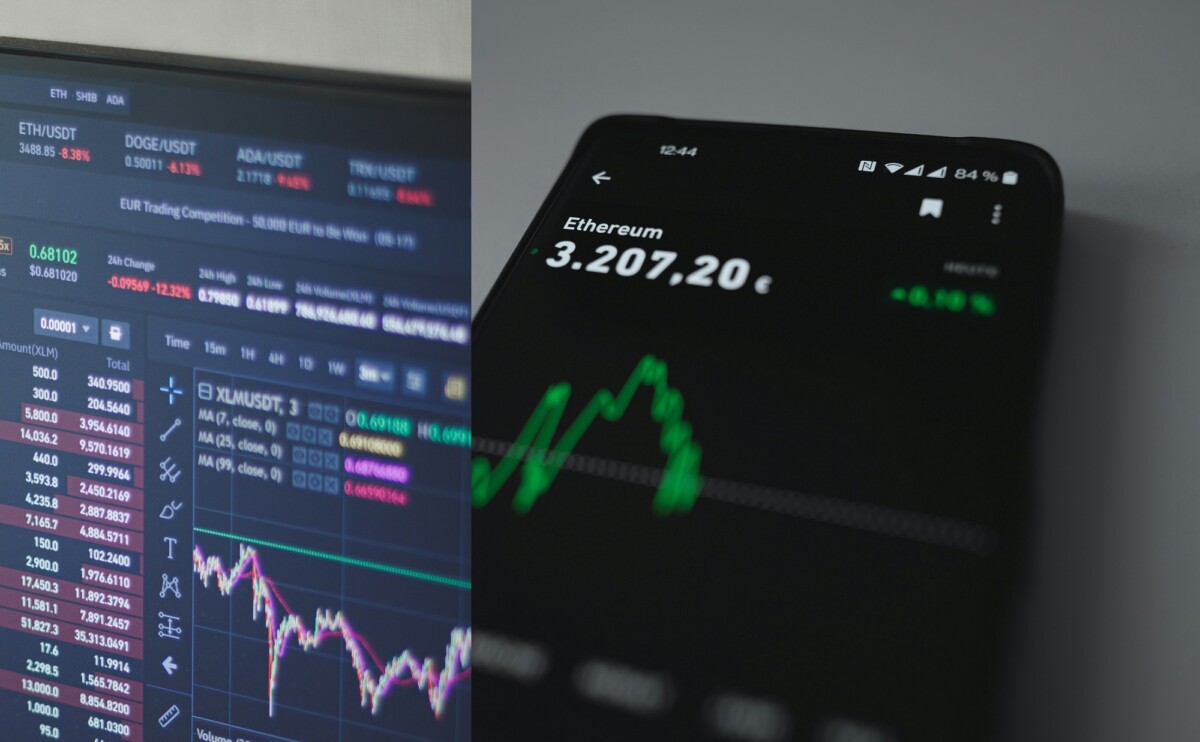

- Bitcoin plunged below $90,000 (near $86,600) and Ethereum dropped to about $2,840 — both sharp losses in a single session.

- Roughly $646 million in leveraged positions were liquidated across major exchanges in early trading, fueling the carnage.

- Market-wide panic erased an estimated $140 billion in crypto market cap within hours.

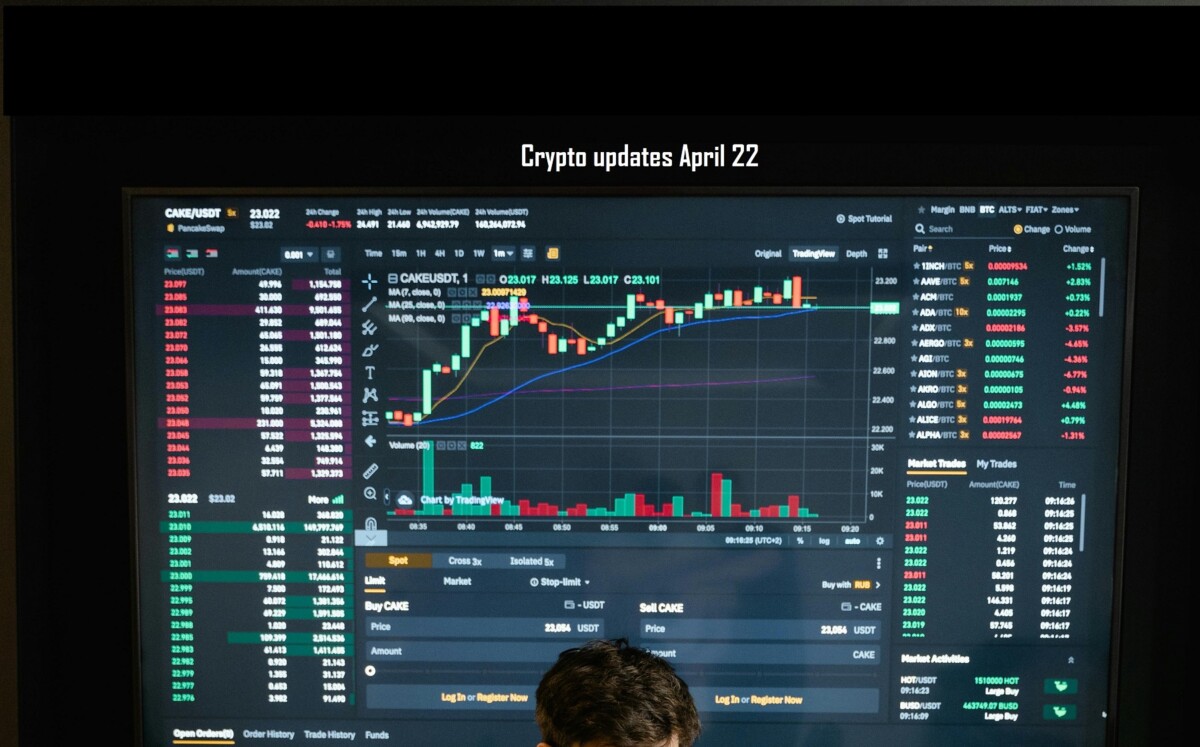

- The crash did not hit just BTC and ETH — many altcoins and risk-heavy assets also sank, as leverage, ETF outflows, and macro uncertainty converged.

What Happened — The Crash Unfolds

Sudden Price Collapse

- On Monday, Bitcoin dropped about 5% overnight — tumbling from around $91,000 to roughly $86,627.

- Ethereum lost about 6%, slipping below $2,900 in quick succession.

- The drop in top cryptocurrencies ignited a broader rout across altcoins and smaller tokens, dragging the overall market down steeply.

Liquidations Amplify the Carnage

- Early-day trading saw around $646 million in leveraged long positions liquidated on major exchanges — with roughly 90% of those being longs.

- The sudden deluge of forced selling drained liquidity. As bids dried up, prices dropped further — a snowball effect.

- The result: an estimated $140 billion — across the entire crypto market — vanished in a matter of hours.

Why the Crash Happened

Over-leverage + Fragile Liquidity

- Many traders had taken highly leveraged long positions. When Bitcoin and Ethereum prices dipped slightly, automatic liquidations kicked in, accelerating the fall.

- Crypto markets remain relatively shallow: once selling momentum builds, buy orders vanish quickly, worsening price swings.

Macro Pressure & Risk-Off Mood

- Global economic uncertainties — including shaky equity markets and weak risk appetite — pushed investors away from volatile assets like crypto.

- ETF flows didn’t provide support. Outflows from big spot-BTC ETFs added selling pressure instead of absorbing it.

Market Psychology & Weekend Illiquidity

- The crash began over a weekend — trading volumes thin. Without strong buy support, even modest sell pressure triggered a cascade.

- Fear amplified quickly. Once BTC and ETH started dropping, panic spread to altcoins as investors raced to reduce risk.

What This Means — For Investors & the Market

Risk of High Leverage

If you’re trading with leverage — especially high multiples — today’s events are a wake-up call.

- Even small price swings can wipe out capital fast.

- Risk is not just about direction — it’s about liquidity and timing.

Market Fragility is Here to Stay

Crypto remains ultra-sensitive to macro sentiment and external shocks. The “always-on volatility + thin liquidity” dynamic means sudden crashes — and rebounds — will likely continue.

Long-Term Implications

This crash may push more investors toward lower-risk strategies:

- Holding spot assets instead of leveraged futures

- Diversifying across less volatile asset classes

- Focusing on long-term fundamentals rather than short-term gains

It could also nudge regulators and major institutions to rethink derivatives exposure in crypto — potentially leading to stricter rules or safer market structures.

FAQ

A1: It reflects market cap loss — i.e. value erased on charts when coin prices fell. Not all holders have “realized” losses (sold), but those using leverage or liquidation-prone positions likely faced real write-downs.

A2: It’s possible — but recovery depends on a return of investor confidence, fresh buying (especially from institutional investors), and stabilization of macroeconomic conditions. Until then, high volatility remains.

A3: Avoid excessive leverage. Diversify holdings. Use stop-losses. And treat crypto as a volatile asset — only invest what you’re ready to lose.