As of 11 October 2025, the crypto market Bitcoin today is under pressure, with Bitcoin retracing sharply and Ethereum similarly posting losses. Markets are roiled by macroeconomic shocks, tariff announcements, and record-scale liquidations.

Bitcoin Slides After Tariff Shock

Bitcoin extended its decline on Saturday, trading around $111,773 USD, down significantly from recent highs. The drop follows a dramatic escalation in U.S.–China trade tensions, including the imposition of 100 % tariffs on Chinese technology exports.

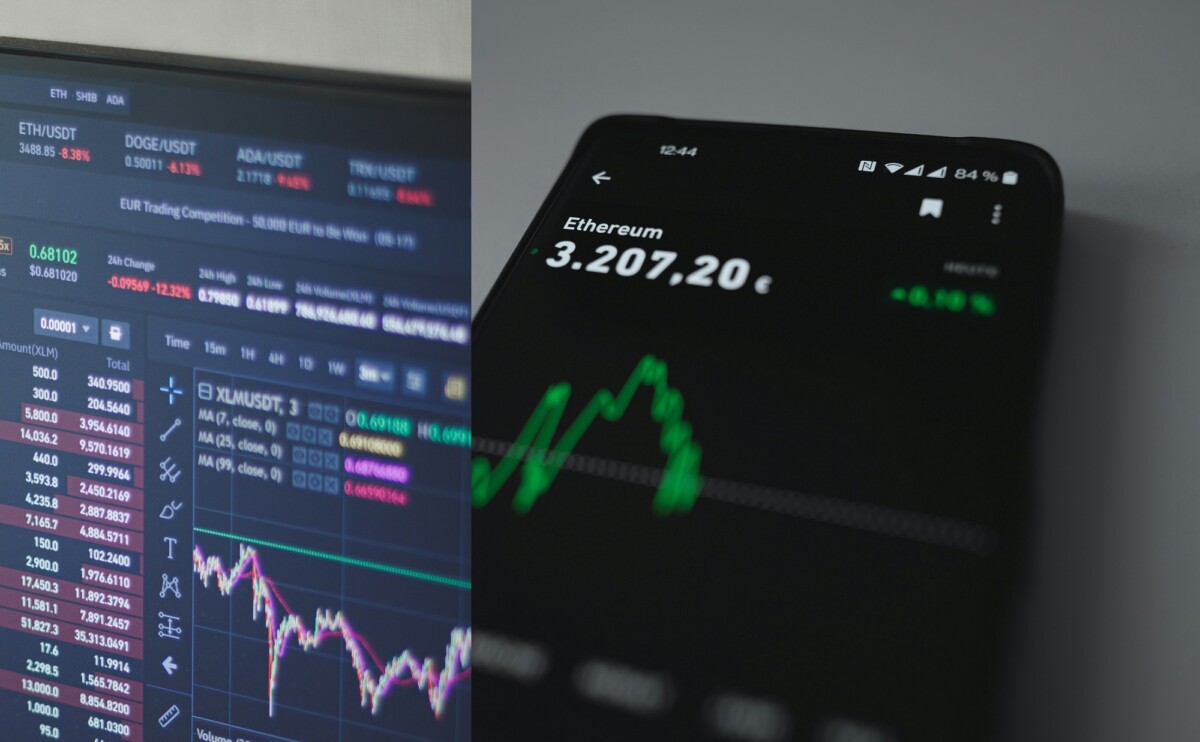

Ethereum also plunged, falling to approximately $3,833.82 USD, as broader risk-off sentiment enveloped the crypto market.

More than $16 billion in long positions were liquidated globally amid the collapse, underscoring the severity of the sell-off.

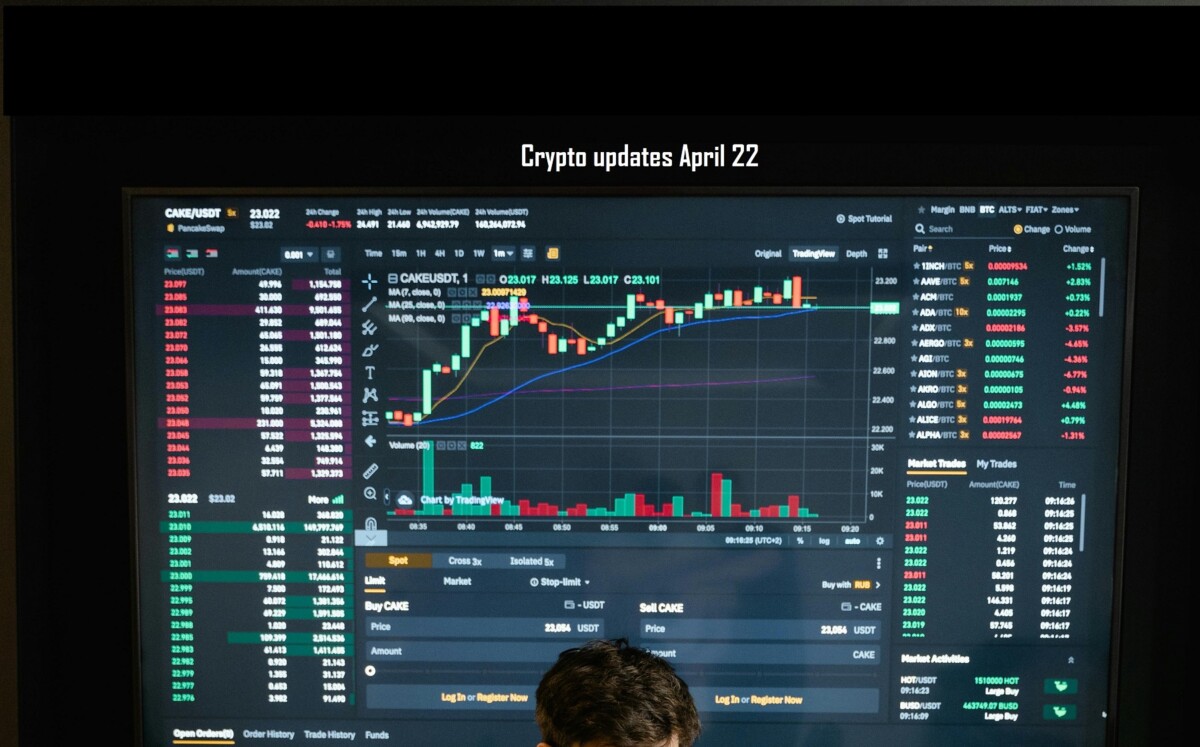

Recent History & Chart Context

Over the past week, Bitcoin had surged to a record level above $125,000, driven by inflows into ETFs and speculative momentum.

However, yesterday’s tariff announcements triggered a steep reversal. Bitcoin briefly dipped below $108,000 on certain trading platforms before finding tentative support.

Technical analysts note a consolidation pattern between $118,000 and $120,000 as critical support zones. A break below could invite further downside.

On Ethereum’s side, its price has lagged behind Bitcoin’s volatility but still reflects the broader downward pressure.

Drivers: Tariffs, Policy, and Macro Risks

The catalyst for the downturn was President Trump’s announcement of sweeping tariffs on Chinese tech imports and export restrictions on key software. These measures spooked global markets and led to sharp de-risking moves.

Macro observers also point to expectations of upcoming U.S. Federal Reserve policy decisions. With markets pricing in a strong likelihood of a 25 basis point rate cut in October, some investors had bet on continued crypto strength—but the current reversal suggests confidence is wavering.

Outlook & 2030 Prediction

Despite today’s weakness, many analysts remain optimistic on the long-term trajectory of Bitcoin.

- Some models suggest that Bitcoin might close the year near $135,000 if dovish signals from the Fed emerge.

- Others offer bold forecasts: Changelly expects Bitcoin to range between $124,453 and $132,701 during October 2025.

- For 2030, predictions vary widely; some bullish estimates place 1 BTC at $250,000 or more, though such forecasts depend on assumptions about adoption, regulation, and macro regimes. (Analysts cited in crypto-forecast forums)

For Ethereum, Citi projects a year-end price near $4,300, while Standard Chartered raised its forecast to $7,500 for 2025.

What This Means for Investors

- Volatility remains elevated. The crypto market is highly reactive to macro and policy shocks.

- Support levels are key. For Bitcoin, $118K–$120K is crucial; a move below that could open further downside.

- Long-term bets remain high-risk, high-reward. While 2030 predictions are alluring, intermediating years may see large swings.

- Diversification and risk management matter. Given the size of recent liquidations, position sizing and stop-loss discipline are essential.

FAQs

A: At current rates, 1 BTC is about $111,773 USD.

A: $1 USD converts to approximately 0.00000894 BTC (reciprocal of the BTC/USD price).

A: It’s in a sharp downtrend, retracing from all-time highs and entering a consolidation range after tariff-induced selling.

A: Forecasts vary widely: some bullish models suggest $250,000+ by 2030, though actual outcomes depend on regulation, adoption, and macro trends.