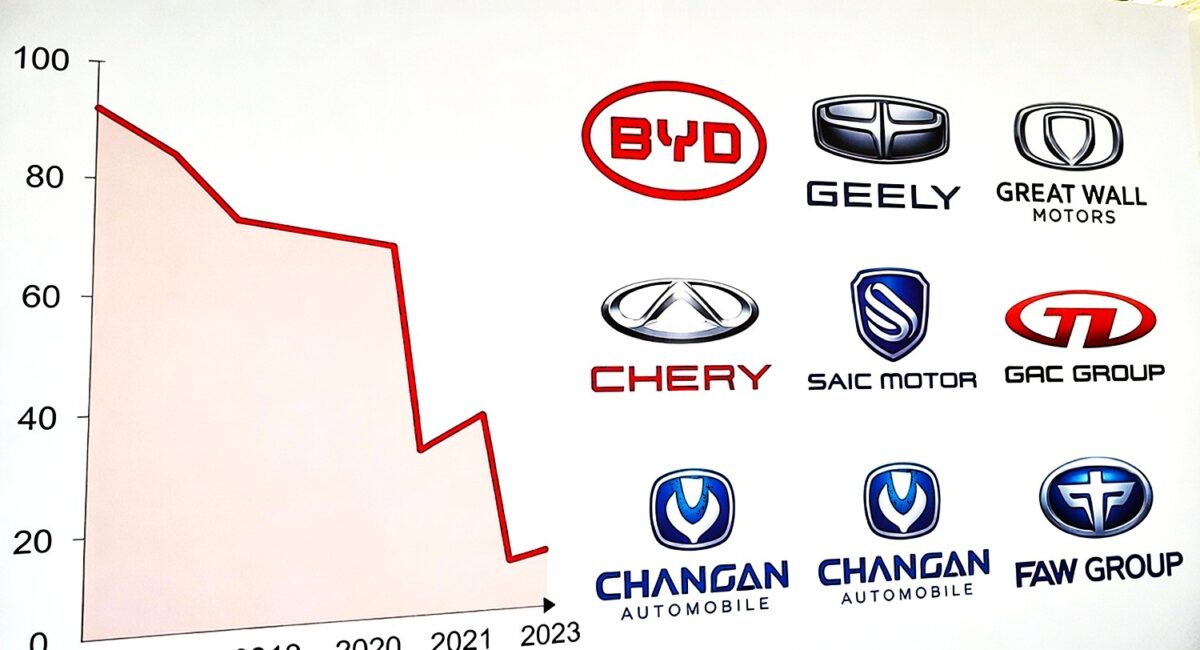

China’s retail passenger vehicle sales dropped sharply — down 19.5% year-on-year to approximately 1.4 million units in January 2026, as weakening subsidies, subdued consumer demand and intense price competition weighed heavily on the domestic auto market, even as new energy vehicle (NEV) exports surged, reflecting a growing reliance on overseas demand amid mounting overcapacity and price wars.

Why China’s Auto Market Is Sputtering

In economic cycles, patterns often show that downturns hit consumer-driven markets first — and China’s auto sector in early 2026 illustrates this all too clearly. January’s year-over-year decline — the steepest since February 2024 — isn’t just a statistic; it’s evidence of a broader structural shift.

Retail Passenger Car Sales Down 19.5%

According to official data from the China Association of Automobile Manufacturers (CAAM), retail passenger vehicle sales in January fell 19.5% compared with January 2025, dipping to around 1.4 million units. That represents a sharp reversal in a market that had become the largest in the world for automobiles.

This drop is not random:

- Reduced government subsidies and incentive programs, including the expiration of tax exemptions on NEVs, removed key price supports for buyers.

- Seasonal effects, like the earlier-than-usual Lunar New Year holiday timing, pulled some demand forward into December 2025.

- Tighter regulations and stronger competition also lowered bargain pressure on automakers.

Put plainly, the market that once seemed inexorable is cooling fast — and it’s hitting both traditional internal-combustion vehicles (ICEVs) and electric vehicles at the same time.

The New Energy Vehicle (NEV) Puzzle

NEVs — which include battery electric vehicles (BEVs), plug-in hybrids (PHEVs) and fuel-cell vehicles — had been the backbone of China’s auto growth throughout the early 2020s. But the January 2026 data reveal a complex story.

Domestic NEV Sales Also Fell

China’s NEV sales in January fell about 18.9% year-on-year domestically, reflecting softer consumer demand for electric vehicles in the home market.

This is significant because NEVs had been outpacing the broader market for years. That momentum is now tapering as purchase tax exemptions were removed in 2026 and trade-in subsidies have yet to fully take effect, raising out-of-pocket costs for buyers.

NEV Export Growth

At the same time, Chinese NEV exports more than doubled in January, reaching record levels. This bifurcation signals overcapacity at home and increasing reliance on global markets. Manufacturers like BYD, Geely and others are pushing aggressively overseas, from Europe to Latin America, to compensate for domestic softness and to mitigate margin erosion from domestic price wars.

Export markets — particularly Southeast Asia, South America and parts of Europe — are emerging as critical lifelines for China’s auto giants, allowing them to ship excess inventory that would otherwise compete in a weaker home market.

Company-Level Realities: Winners and Losers

The national figures mask big differences among manufacturers:

BYD: A Bellwether for the Market

BYD — once the poster child for China’s NEV boom — saw its January domestic passenger car sales plunge nearly 30% year-on-year. This includes both BEVs and PHEVs, with pure electrics down more sharply, highlighting the demand slump even for top brands.

To counteract this, BYD is pushing global expansion with new facilities and sales efforts abroad, particularly in Brazil, Hungary and other markets.

Tesla in China

Interestingly, Tesla’s China operation bucked the overall domestic downturn, reporting a modest ~9% year-over-year increase in January sales. This suggests that pricing and financing strategies (like 7-year financing offers) can still drive demand even amid broader weakness.

Other Chinese Brands

Smaller players saw mixed results:

- Startups like Xiaomi Auto gained ground with new deliveries.

- Traditional players like Li Auto and XPeng saw sales declines, highlighting sharp competitive pressures.

This divergence underscores how market positioning, pricing strategy and global reach are becoming decisive factors in survival — and which players are poised to thin out in a consolidation phase.

Root Causes: Policy, Incentives and Price Wars

China’s auto sector has been underpinned for years by a web of government incentives. But as 2026 began:

- Purchase tax exemptions for NEVs were scrapped and replaced with a standard 5% tax, raising effective prices.

- Trade-in and subsidy programs expired or transitioned without full new replacements, leaving a policy vacuum.

- Price wars intensified, particularly among domestic NEV makers trying to defend share, compressing margins.

This confluence of factors hasn’t just cooled demand — it’s reshaping competition and profitability. Markets moved from subsidy-driven growth to price-driven battles, making long-term margins more tenuous.

Economic and Seasonal Effects

The timing of the Lunar New Year pulled some buying into December 2025, artificially deflating January numbers.

But even accounting for seasonality, industry associations and analysts point to weaker consumer confidence amid broader economic pressures — including slower household income growth and cautious lending conditions — as structural headwinds rather than short-lived fluctuations.

Implications for 2026 and Beyond

China’s auto market isn’t collapsing, but it is restructuring:

- Domestic sales — especially retail — are under significant pressure.

- Exports are rising, but overreliance poses geopolitical and supply chain risks.

- Price wars and subsidy removals are squeezing margins and reshaping competitive hierarchies.

Some analysts predict the sector could struggle to return to strong growth unless new consumer incentives are introduced or demand recovers significantly — a scenario not guaranteed in the near term.

Conclusion: A Turning Point for China’s Auto Sector

The 19.5% drop in January retail vehicle sales isn’t just a snapshot — it’s a symptom of deeper shifts in consumer behavior, policy frameworks and global demand dynamics. While NEV exports offer promise, they also underline how China’s auto leaders must now pivot beyond inward-focused growth or face shrinking domestic markets and margin erosion.

Through this lens, January 2026 may be remembered not just as a downturn, but as a strategic inflection point — where China’s automotive industry transitions from subsidy-fuelled expansion to market-driven global competition.